Chart of the Day: Bitcoin Debunked

First Victim of the Liquidity Squeeze

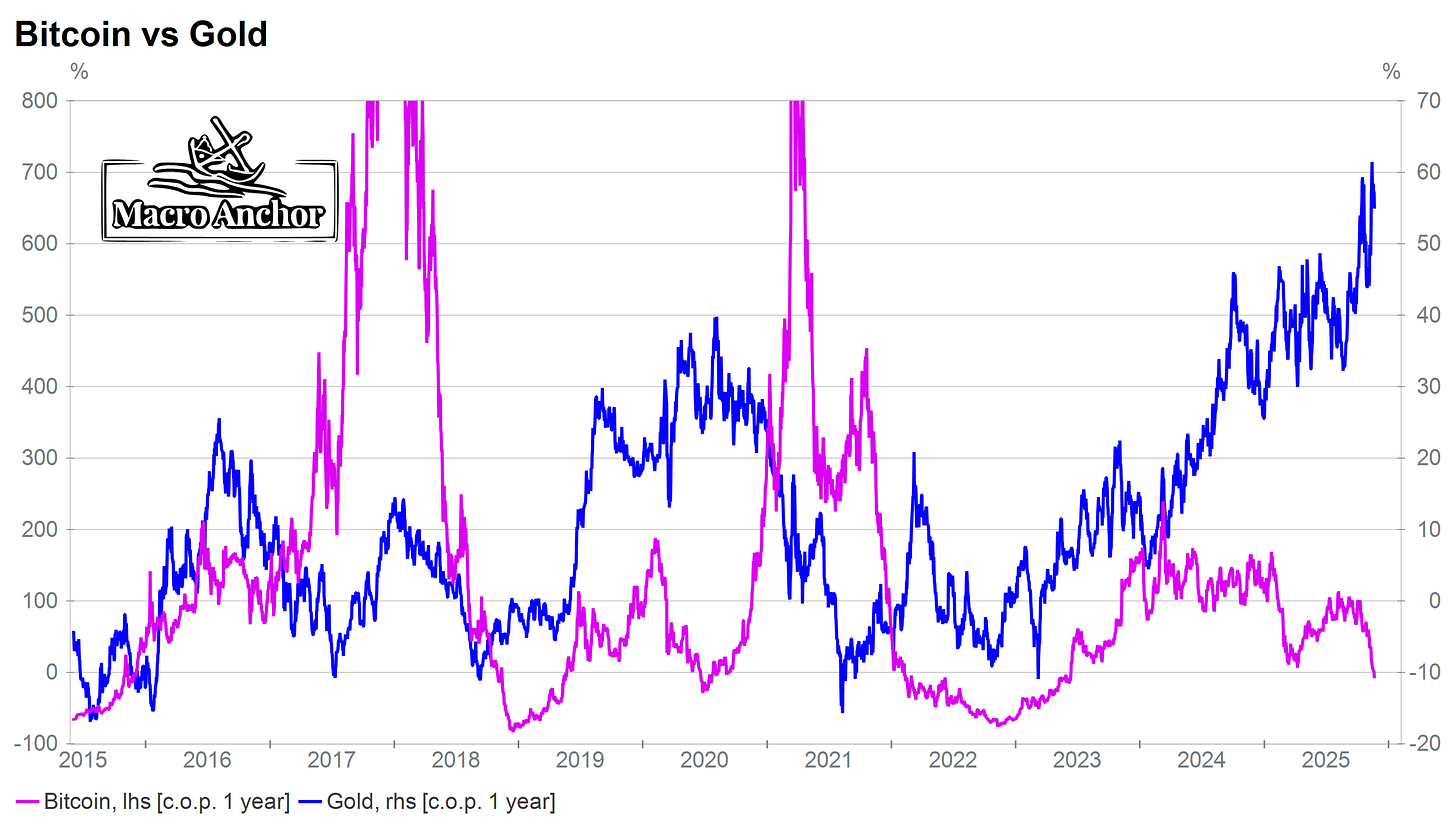

For years, the loudest voices in crypto insisted that Bitcoin was “digital gold.” They claimed it was a superior store of value, a hedge against inflation, and a monetary alternative immune to political cycles. Their favourite argument was always the same: Bitcoin and gold move together. They would point to periods where both assets rose and declare that the correlation confirmed Bitcoin’s monetary status.

That narrative has now collapsed.

If Bitcoin were truly a store of value, and gold is the ultimate benchmark for that role, both assets should move in tandem over time. They should not track each other perfectly, but they should at least be directionally aligned on a year-over-year basis. Instead, the opposite is happening. The correlation has not only broken, it has turned negative. In Econometrics, when we want to test a correlation between two series, it is recommended to de-trend the two series and then find if there is a correlation between the two series.

When we take the year-over-year change in Bitcoin and regress it against the year-over-year change in gold prices, the results are unequivocal. From 2023 onwards, the coefficient becomes negative. The relationship does not just weaken; it inverts. In other words, at the very moment when gold has been reaffirming its status as the world’s store of value, Bitcoin has been behaving like the opposite.

If we extend the regression from 2013 to today, the conclusion is even clearer. The R² is effectively 0%. A decade of data shows no explanatory power whatsoever between gold returns and Bitcoin returns. The coefficient is negative, statistically insignificant, and the intercept is large and positive. This tells you that Bitcoin’s returns have nothing to do with gold, nothing to do with value preservation, and nothing to do with monetary fundamentals.

Bitcoin trades like a speculative instrument. It rises when liquidity is abundant, credit is plentiful, and risk appetite is high. It collapses when financial conditions tighten, and liquidity evaporates. The behaviour is indistinguishable from high-beta tech stocks or leveraged risk trades. There is no anchor, no intrinsic value, no connection to the real economy, no link to any cash flow or asset base, and certainly no monetary function.

Gold, by contrast, continues to behave exactly as a store of value should even when liquidity tightens. It responds to real interest rates, fiscal dominance, geopolitical uncertainty, and long-term stability of the currency system. It is held by central banks, integrated into the global monetary architecture, and protected by thousands of years of history. Gold is an asset. Bitcoin is not.

If the correlation breaks, if the regression shows no relationship, if the R² is zero, and if the coefficient is negative, then the conclusion is simple. Bitcoin is not a store of value. Bitcoin is not money. Bitcoin is a speculative, high-volatility instrument that depends entirely on liquidity cycles and investor sentiment. It is based on nothing and anchored to nothing.

That does not mean it cannot rise or fall. It simply means it has no role in monetary stability, no store-of-value proposition, and no connection to gold. The narrative was wrong from the beginning and Mr. Saylor is very but very wrong.

Regards,

Andre Chelhot, CFA

Editor,

The Macro Anchor

Richard Werner (fluent Japanese speaker) makes the point that the founder of bitcoin's name translates: community intelligence. (all Asian languages put last name first)

The regression work here is spot on, Andre. We’ve seen the exact same breakdown in our internal models—the "Digital Gold" narrative has completely decoupled from the price action.

At Lighthouse, we moved to treating BTC exclusively as a high-beta function of Net Liquidity and RRP drain. That specific "liquidity proxy" behavior is exactly what triggered our defensive posture (max cash/reduced lev) prior to the recent drop. When the plumbing signals stress, the asset class correlates to risk, not value.

We just published a note on the realized alpha from trading that exact Liquidity Transmission mechanic (vs. holding the "store of value" bag).

Excellent work on the correlation data.

[https://substack.com/@lighthousemacro/note/c-179595918?utm_source=notes-share-action&r=ofv6e]