Weekly Macro and Policy Wrap-Up

The Era of Policy Fragmentation

United States

The conditions that once rendered macroeconomics irrelevant have vanished. The world that dismissed macro as a redundant discipline, a world of synchronized cycles, anchored inflation, and passive investing masquerading as risk management, no longer exists. The Great Moderation erased macro signals for more than a decade, but the past two years have made one thing undeniable: macro is back, and the global system cannot function without it.

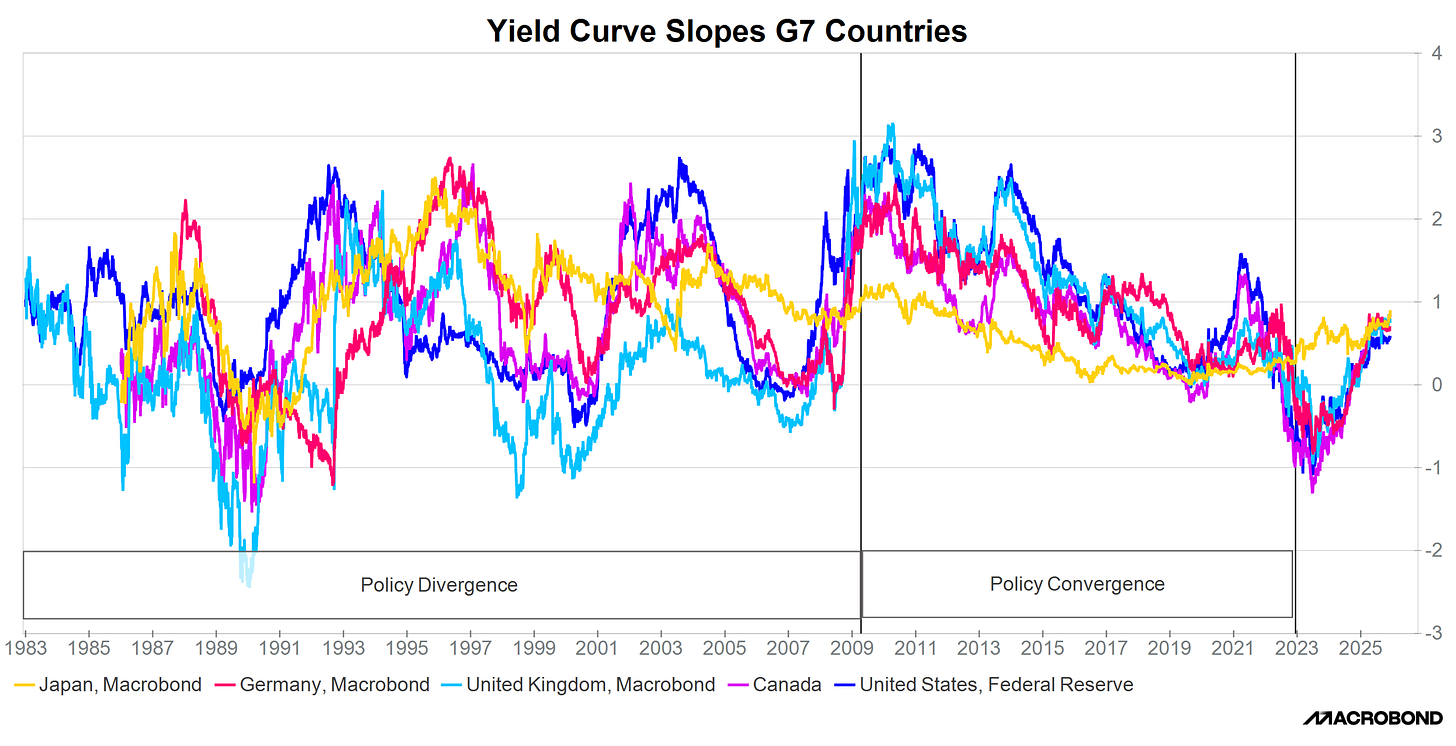

Policy divergence is now the defining feature of the global economy. The United States is moving toward aggressive monetary easing with fiscal neutrality. The Eurozone is embracing fiscal expansion and industrial policy. The United Kingdom faces fiscal tightening and impending monetary easing. Canada is already deep into its easing cycle with deficits shrinking. Japan continues fiscal stimulus while monetary policy drifts cautiously toward neutrality. Five economies, five fiscal stances, five monetary regimes, no point of convergence. Yield curves express these divergences with clarity. During the post-GFC period, curve slopes across the G7 converged; today they fracture again. Relative curve slopes, not policy rates, define FX. When fiscal expansion steepens one curve while tightening flattens another, currencies adjust, capital reallocates, volatility returns, and macro opportunity re-emerges.

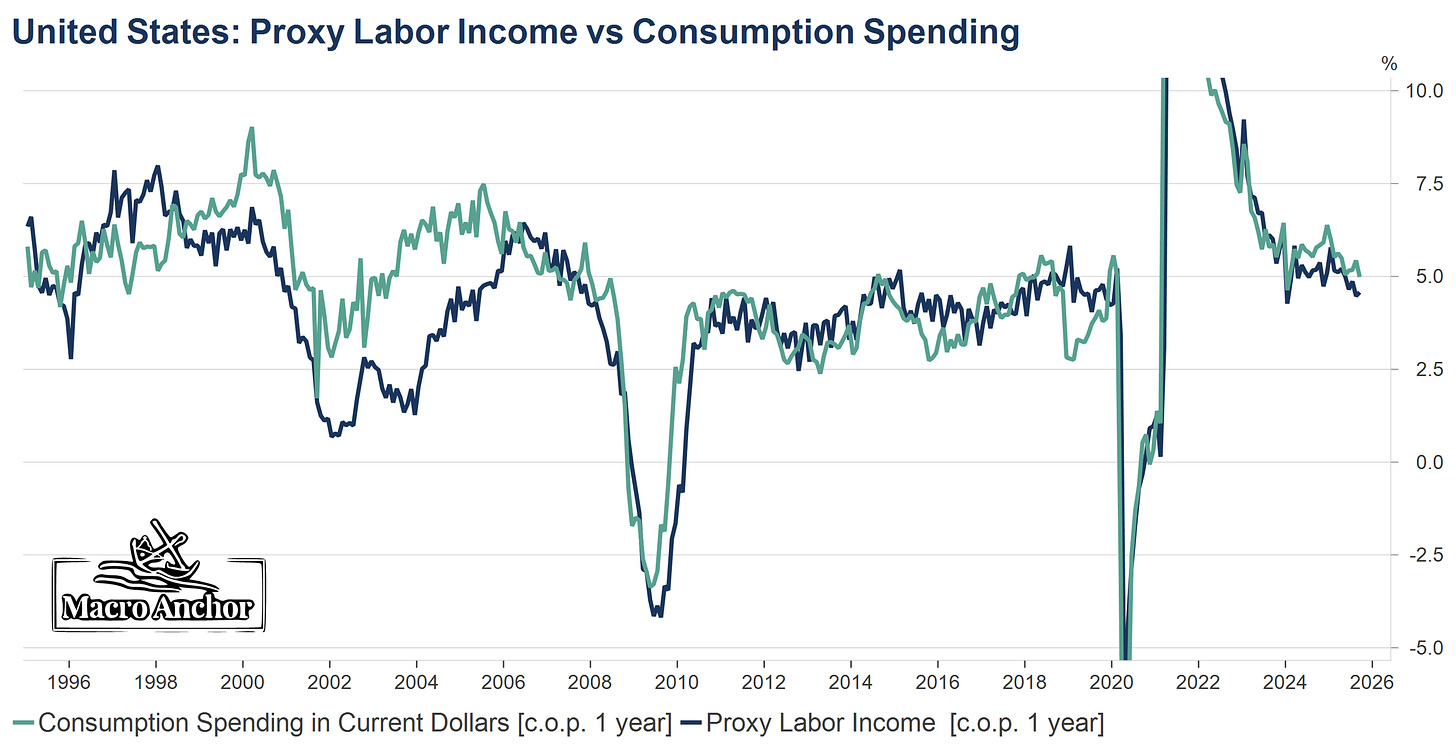

We begin with the U.S. consumer, the centre of gravity of the world economy, where the underlying engine has entered its most fragile phase. Consumption in the United States rests on labour income, credit, and wealth. When these diverge, they reveal everything about the true underlying strength of demand. Today, the divergence is extreme. Labour income has clearly begun to decelerate. It is not collapsing, but the impulse that carried consumption through 2021–2023 is fading. Credit growth collapsed after the tightening cycle. Under normal conditions, consumption would have followed credit lower. It did not. The reason was wealth. Households sat on trillions in home equity, mortgage burdens were historically light, and asset prices were booming. But wealth is the most volatile of the three drivers, and real PCE now confirms the fragility. In July, real consumption rose only 0.1 percent. In August, it rose 0.4 percent. In September, it was flat.

Keep reading with a 7-day free trial

Subscribe to Andre Chelhot to keep reading this post and get 7 days of free access to the full post archives.